June 3, 2018

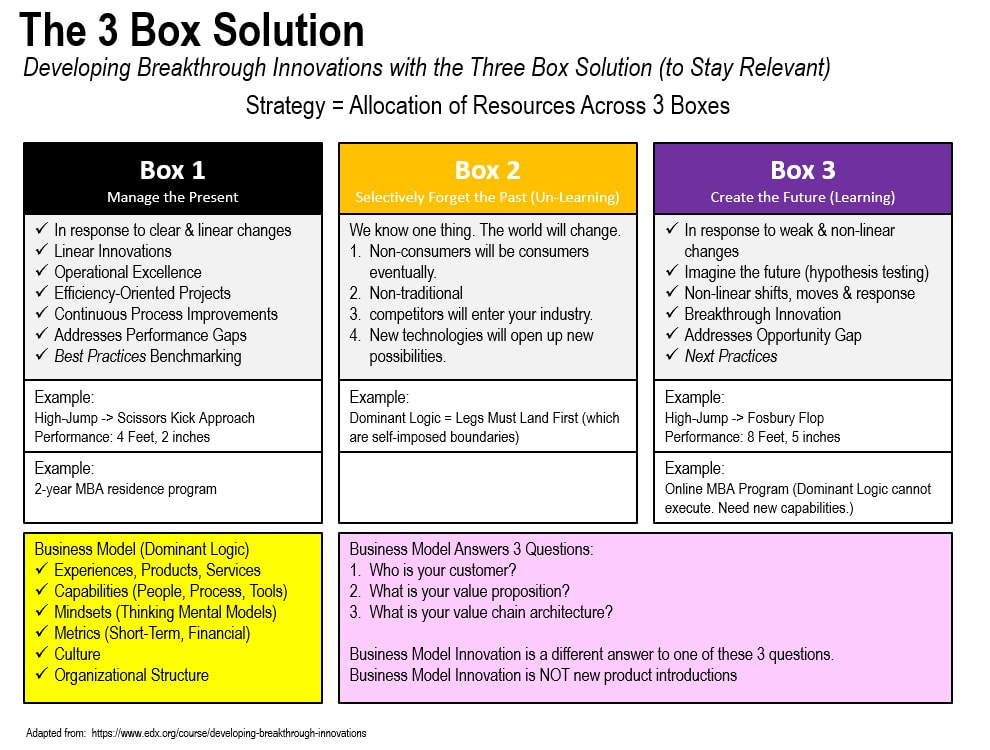

What is it that is preventing you from spending more time in Box 2 and Box 3? What are the barriers that prevent you from spending more time on the future?

There are four challenges or barriers which when coupled together make is nearly impossible for a traditional financial services firm to spend more of its collective time, investment and resources in Box 2 and Box 3. The first challenge is increasing industry competition. One of my clients is a Global 50 financial services organization which offers a wide range of products such as commercial banking, retail banking, mortgage lending and other related banking services. The competition in these markets is intense and even more so with the emergence of the digital giants (e.g., Amazon) as well as the digital disrupting fintech startups (e.g., Prosper, Betterment).

Second, many industry insiders focus their short-term attention on the regulation and compliance rules that have consistently dominated management’s attention since the 2008 Financial Crisis. The consistent wave of these new rules creates demand for new Box 1 initiative which crowds out investment in potential Box 2 and Box 3 programs and experiments.

The third challenge relates to management’s predilection for short-term financial metrics. As a public company, management must satiate shareholders in the short term. This quarterly focus also limits management’s appetite for programs that don’t generate a predictable, return on investment in a timely fashion.

The fourth and final barrier to more non-linear thinking is that many financial service insiders are risk adverse by nature as well as training. Box 3 is about creating the future and thus involves a high degree of uncertainty and risk taking. Perhaps this lack of risk-taking on the behalf of traditional financial services management is the key barrier to Box 3 innovation? The digital giants and fintech upstarts do not face this barrier.