May 22, 2023

Date: 22 May 2023 Source: https://www.barrons.com/articles/bonds-buying-opportunity-fed-rate-pause-d07e3781 Notes according to the article: "Intermediate maturities...are the best best for stable income""Investment-grade corporate bonds are now yielding around 5%, up from about 2.8% two years ago""...last year [2022], when U.S. bonds lost a dismal 13% on a total return basis.""In June, the Fed is expected to pause—meaning hold rates steady, after raising them at each meeting since March of last year""Rate cuts will boost...

Read More →February 4, 2023

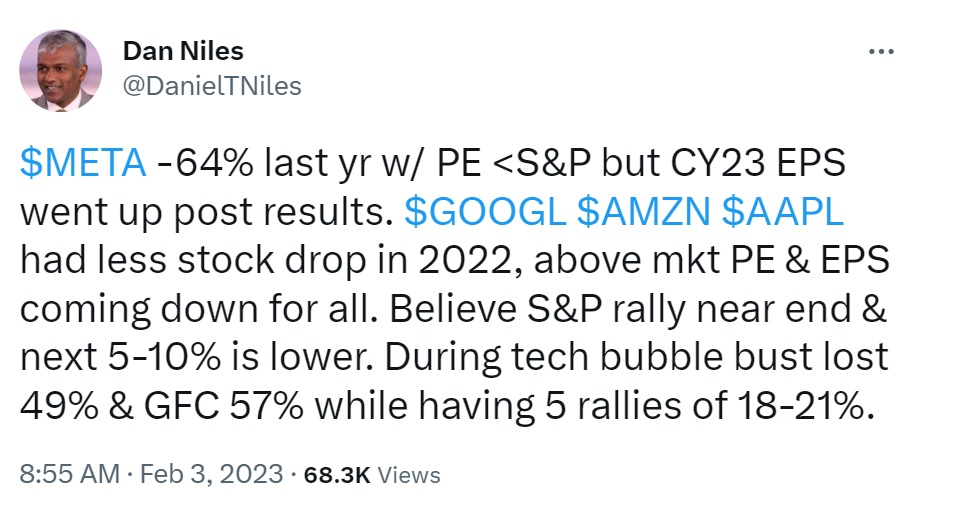

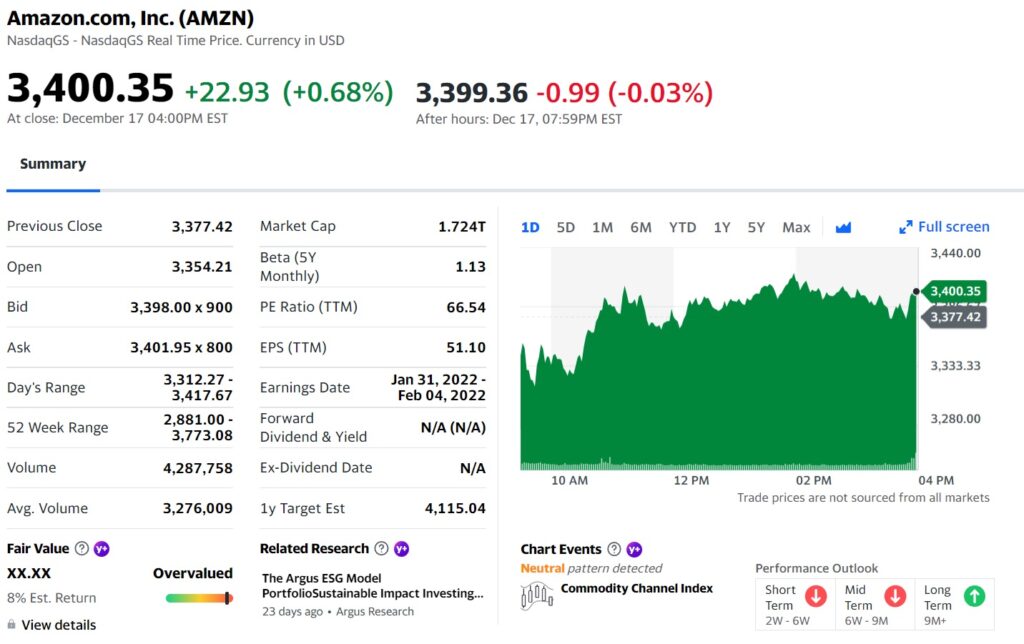

Analysis date: Saturday, February 4, 2023 It will be interesting to see if the S&P can hold its recent low of 3,491.58 It's Friday 3, 2023 4 pm ET cash close was 4,136.48. Source: https://twitter.com/danieltniles/status/1621507624520003585?s=43&t=TVlqvZGAsRVElTAXYdMIUw Source: Google.com

Read More →December 20, 2021

This week's Barron's magazine cover story references the publication's top ten stock picks for 2022. As for last year's results, Barron's top 10 picks slightly trailed (26.9%) the overall market (27.6%) as measured by the S&P 500. The backdrop for stocks in 2022 appears to be more difficult in that the returns for the S&P 500 over the past 3 years have been historically well above average (~ 10%): 27.6%...

Read More →September 12, 2021

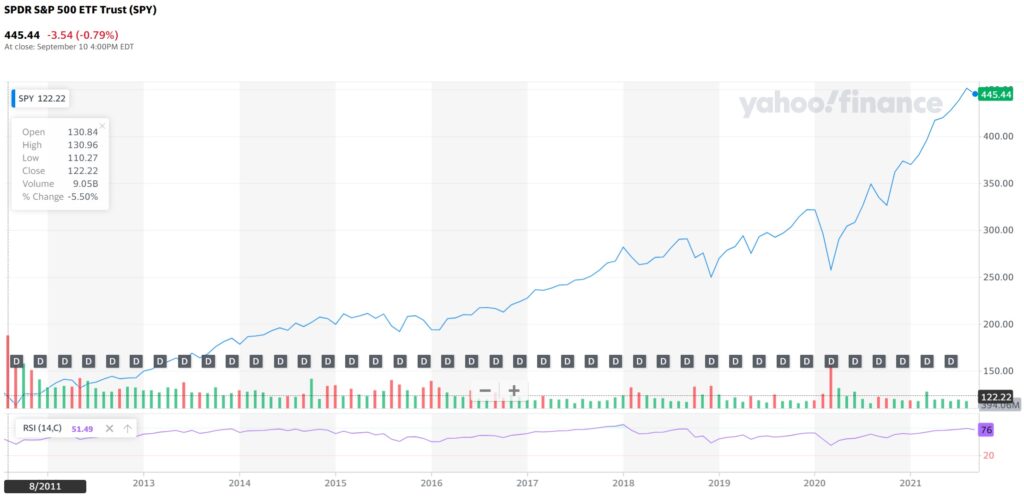

In this weekend's Barron's, one Wall Street strategist predicts the S&P 500 index funds will tumble by Christmas. However, another says the index will continue to run this year —but it will lose money over the next decade. Some other interesting data points: The index has returned 376% over the past decade (2011 - 2021), or close to 17% a yearActive management has trailed over these same 10 years by...

Read More →May 3, 2021

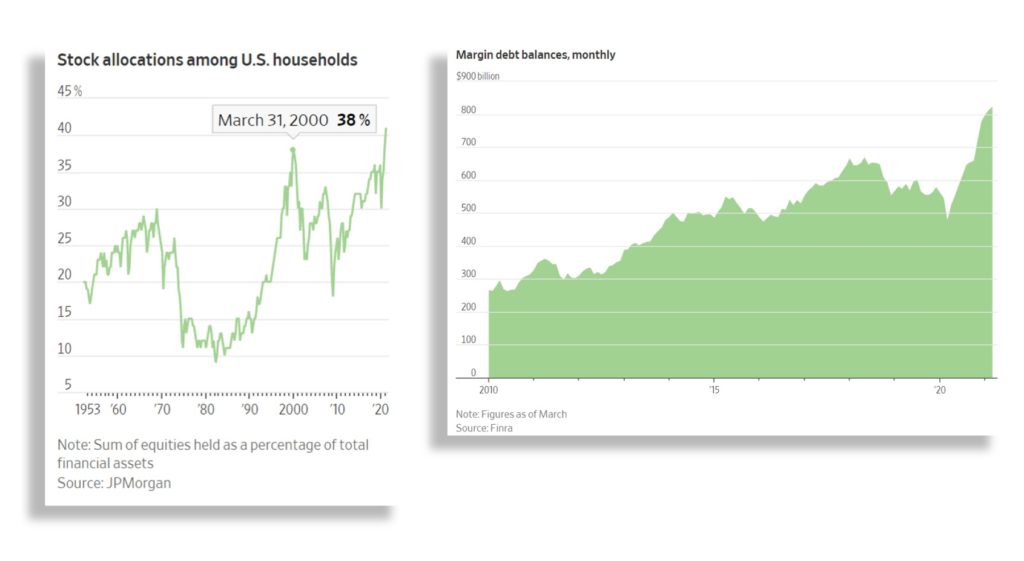

In today's U.S. edition of The Wall Street Journal, a front-page article, titled Americans Can’t Get Enough of the Stock Market, referenced some interesting data: Stockholdings among U.S. households increased to 41% of their total financial assets in April, the highest level on record going back to 1952 that includes 401(k) retirement accountsThe S&P 500 has hit 25 records this year, fueled by a stellar earnings season and the prospect...

Read More →January 25, 2021

According to The Ultimate Guide to Trading ETFs (Dion, 2011): When "odd number of shares" begin to trade more frequently, it's a sign that more retail (individual) investors are buying a stock and has been correlated with marking the top in a stock.

Read More →January 25, 2021

The Treasury yield curve widened to a record, 2.81% amid signs the U.S. economy is strengthening.Source(s): WSJ, iStockAnalyst.com

Read More →January 20, 2021

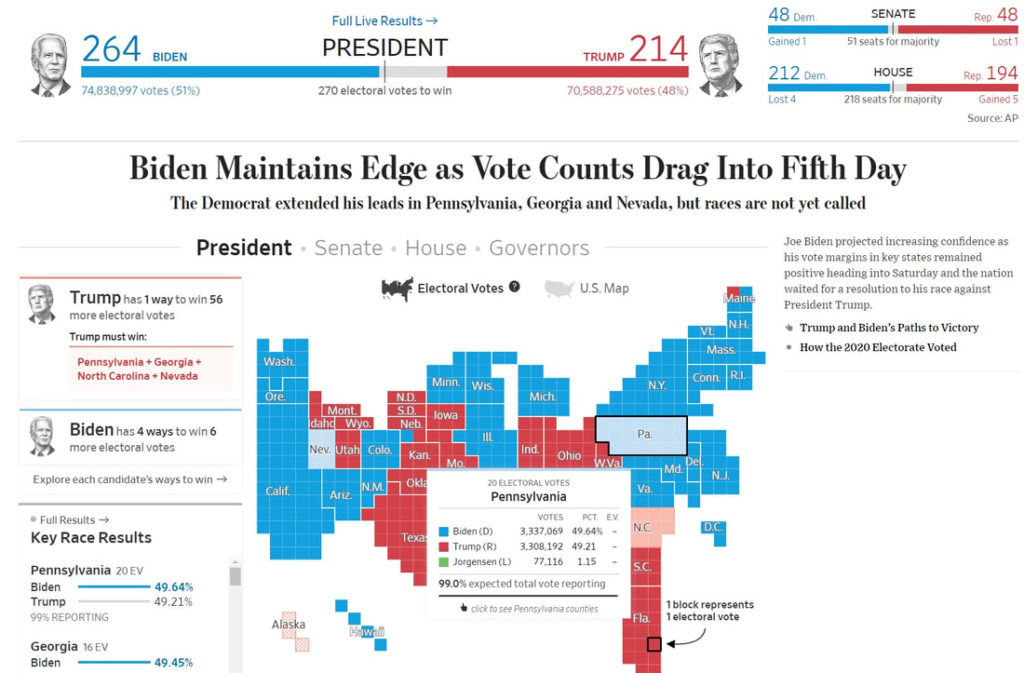

The WSJ data visualization of the 2020 US Election as of Saturday, November 7, 2020. (Source: WSJ, accessed, 11/07/2020, 11:11am ET)

Read More →January 10, 2021

A recent Barron's article, Oldies but Goodies: Some Century-Old Stocks Still Deliver, brings to mind the following challenge for public equity investors - when, how much, and how long, to invest capital in category leaders? Often, category leaders remain on a perch for decades only to fall (or disappear altogether) at some point in the future. Examples, include GM (Cars)MO (Tobacco)X (Steel)SHLD (Retail)IBM (Computing)XOM (Energy) Some do transform (e.g., $APPL,...

Read More →November 28, 2020

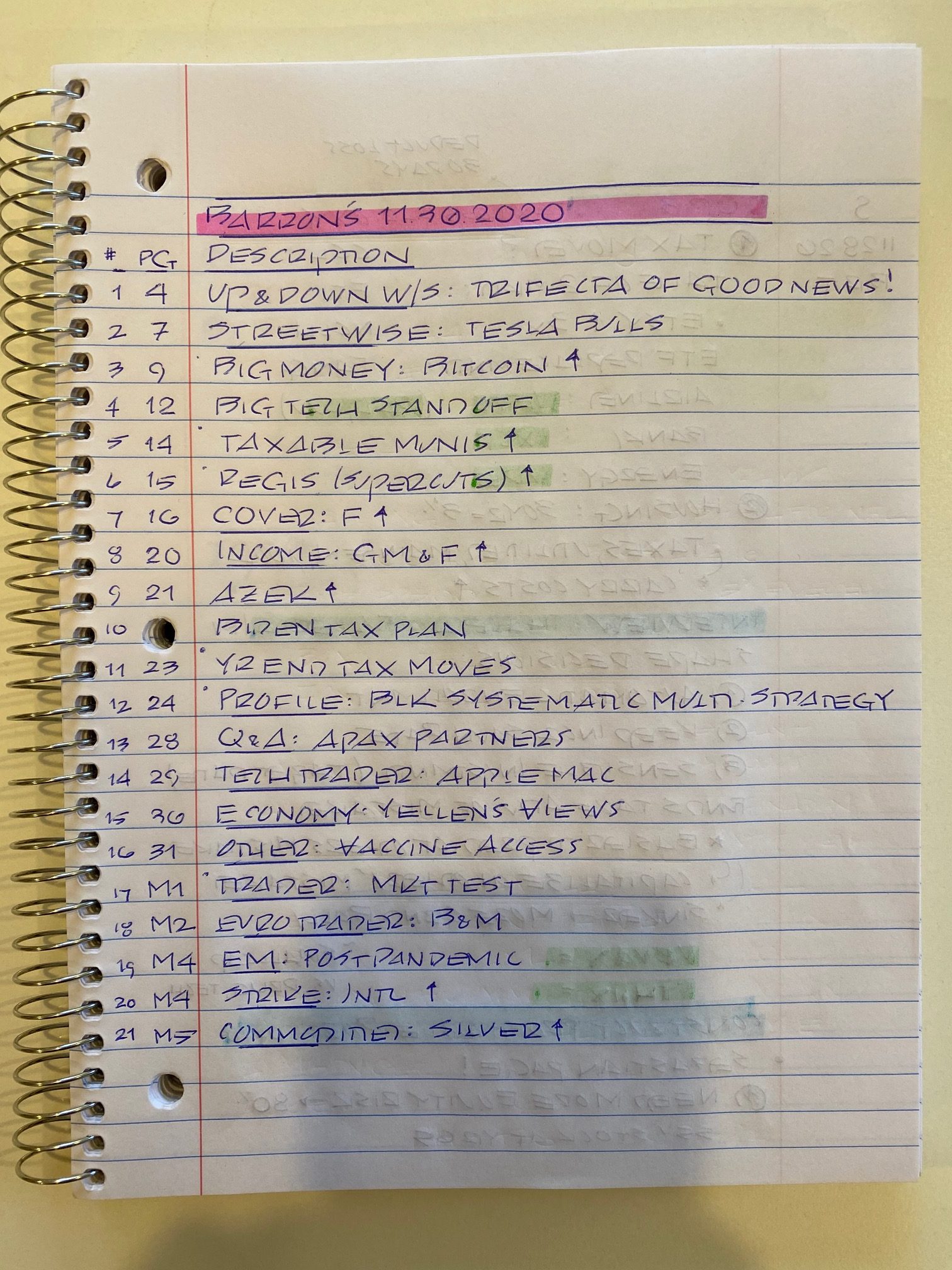

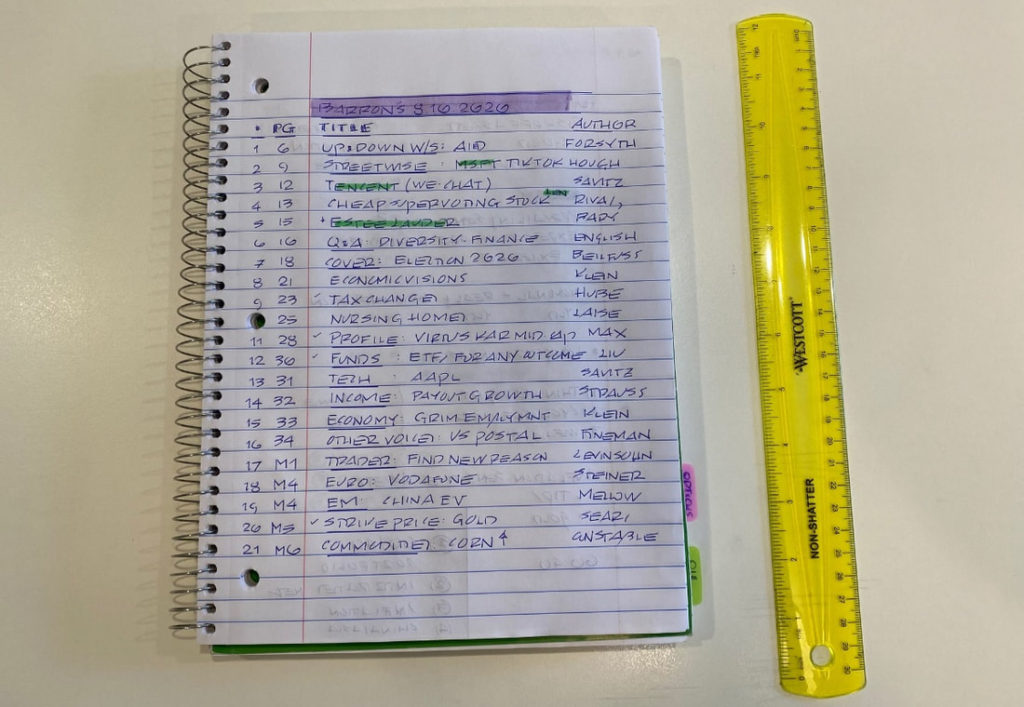

Summary of Barron’s November 30, 2020

Summary of Barron’s November 30, 2020As part of my weekly investment process, I review Barron's weekly magazine's set of financial articles as well as it's televised Roundtable show. I jot notes from both media to help frame topics for future analysis. In this week's media, I found the interview with Richard Thaler to be particularly interesting as he's published research on behavioral finance for quite some time. Summary of Barron's November 30, 2020 Notes of...

Read More →November 9, 2020

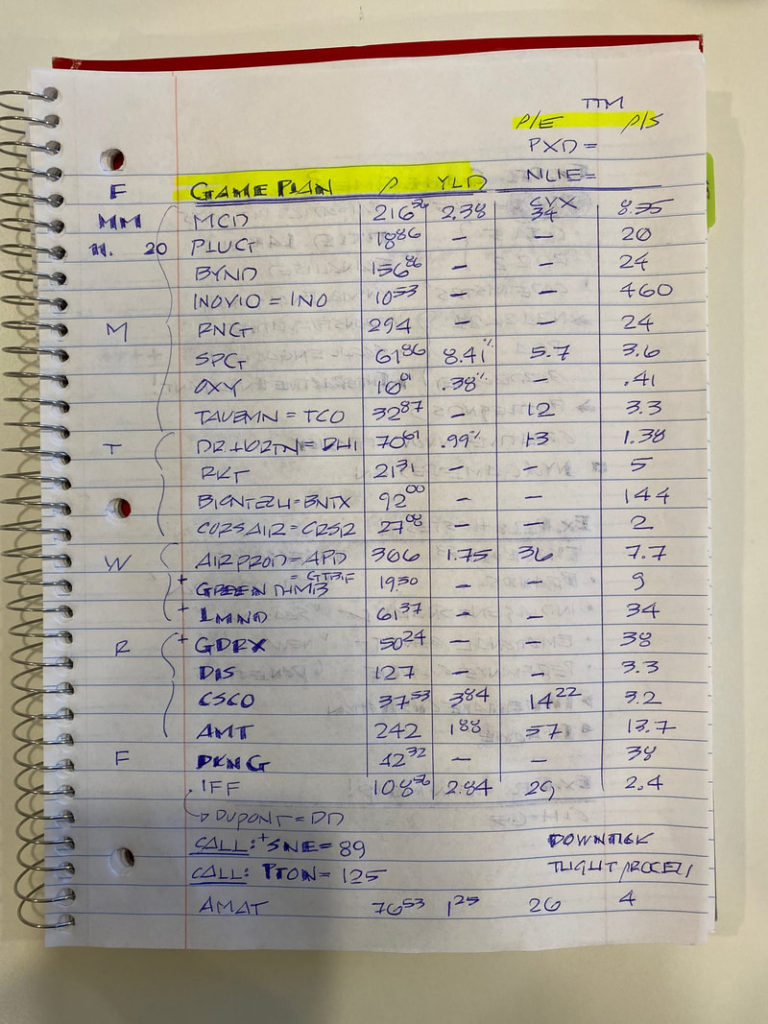

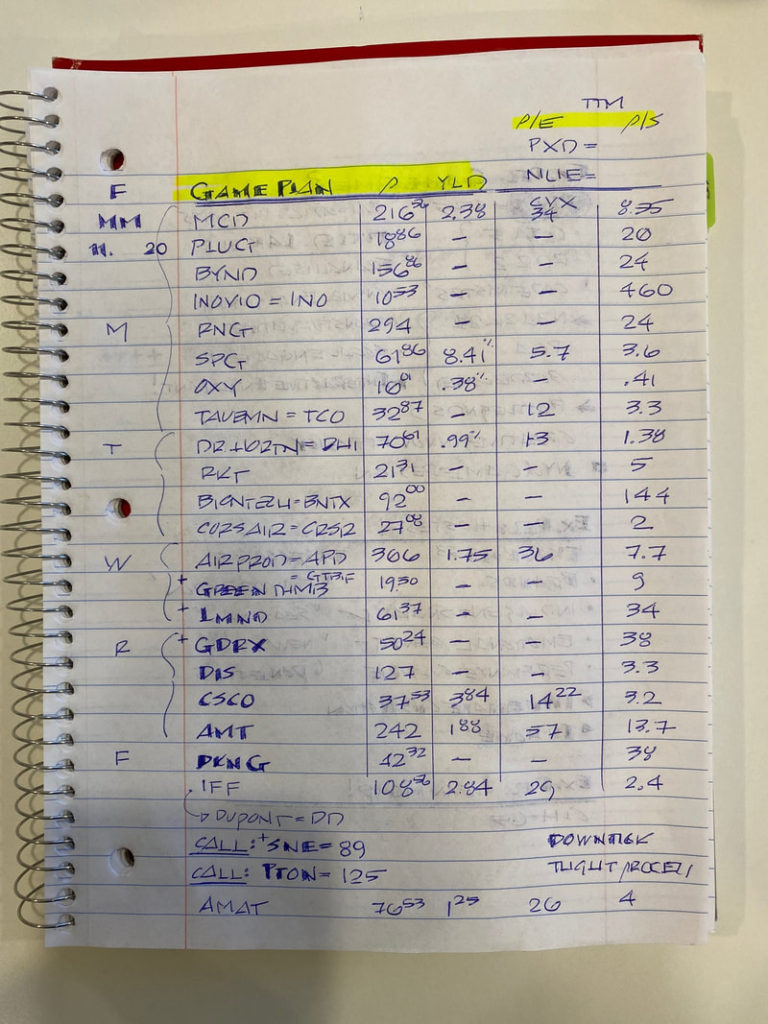

As part of my investment process, I review the following sources, take notes (below) and enrich the data with additional research to help inform my thinking: CNBC Mad Money Friday Game PlanBarron's Weekly MagazineBarron's Weekly TV Show Sources: CNBCBarron'sYahoo Finance (data accessed 11/9/2020, 8:02am ET)

Read More →November 7, 2020

The WSJ published a thought-provoking article in which the author lists doubts about commonplace investing truths. Doubt #1: The Safety of U.S. Bonds The author writes," for many years I’ve assumed bonds will buffer the fluctuations of stocks. In 2008-09 and again for most of this year’s pandemic panic, prices of high-quality bonds like U.S. Treasurys went up as stocks fell. Now, with interest rates close to zero, investors no longer buy...

Read More →November 2, 2020

As part of my investment process, I review the following sources, take notes (below) and enrich the data with additional research to help inform my thinking: CNBC Mad Money Friday Game PlanBarron's Weekly MagazineBarron's Weekly TV Show Sources: CNBCBarron'sYahoo Finance (data accessed 11/9/2020, 8:02am ET)

Read More →October 28, 2020

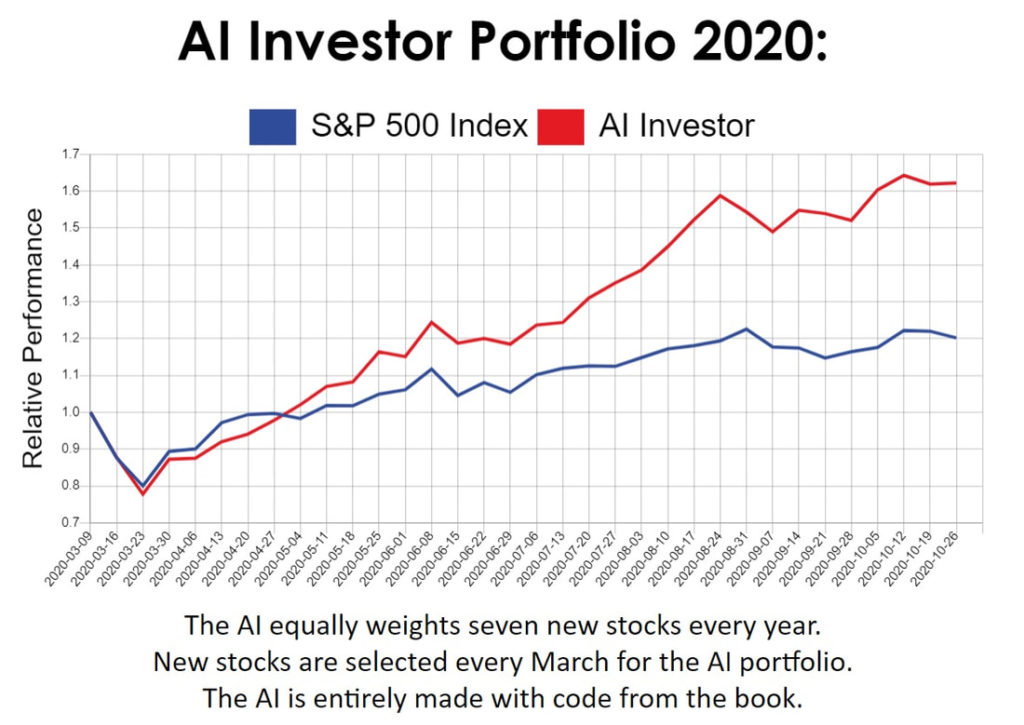

Very interesting book - Build Your Own AI INVESTOR - focused on using Artificial Intelligence to generate alpha.I'll be curious to see how the portfolio does over time. Source: https://www.valueinvestingai.com/

Read More →October 26, 2020

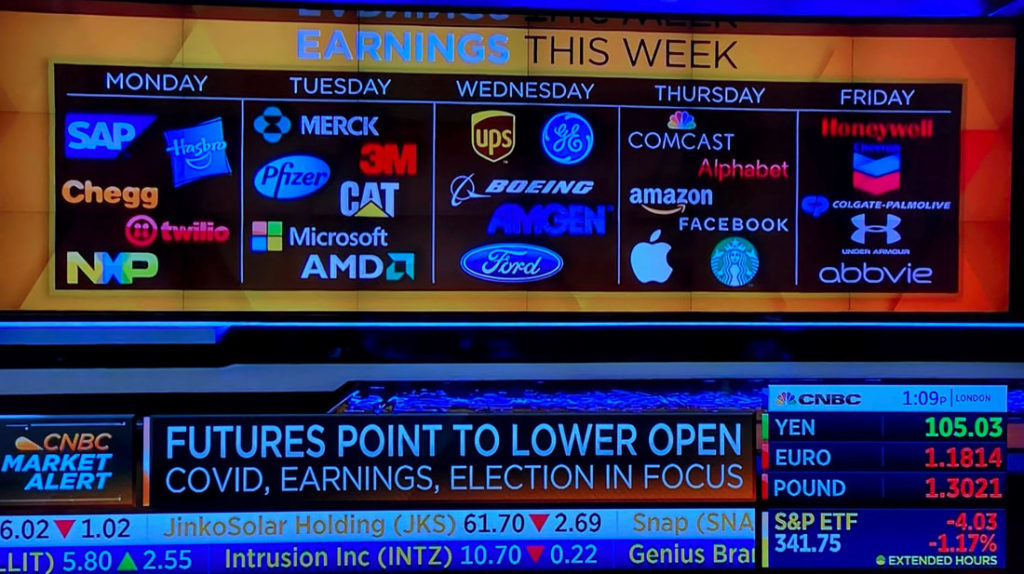

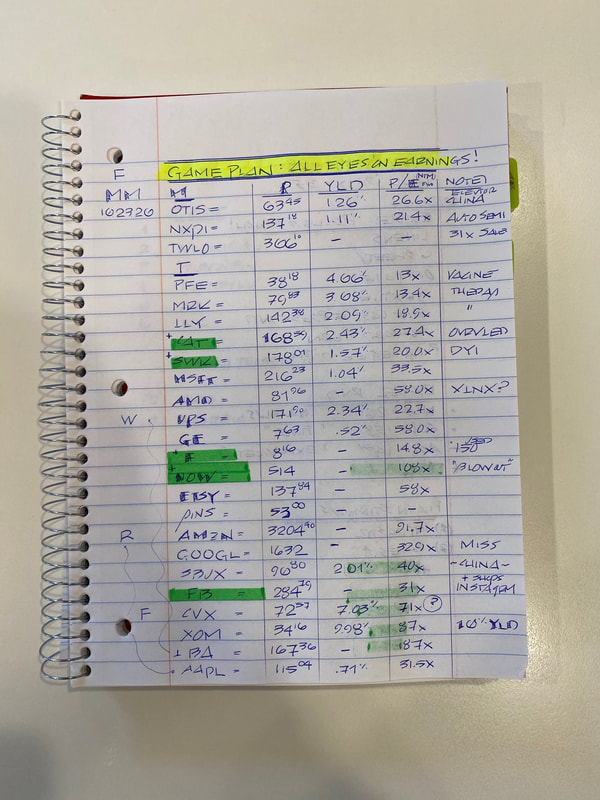

This week (10/26/2020 - 10/30/2020) includes a significant number of public firms reporting 3Q (September) quarterly results. As part of my daily process, I tune into CNBC to check out those stocks that are included in the scoreboard. And, then I enrich the data with pricing information from KoyFin or Yahoo! Finance; and earnings estimates from Zacks.com.In the segment I was viewing, there was additional focus on the pharmaceutical firms...

Read More →October 25, 2020

As part of my investment process, I aim to watch the CNBC Mad Money Friday Game Planread Barron's Weekend Paperwatch Fox News' Barron's weekend TV showreview Zack's Earnings Weekly Calendar before the start of each week. My objective is get a perspective on which companies are reporting earnings as well as the potential business prospects of other firms presented in these media network and publications. Often, I take notes and...

Read More →October 20, 2020

This CNBC chart shows the value of IBM vs. the S&P 500 from 1985 to October 2020. It will be interesting to see how the firm performs following the proposed split of the firm into a cloud and managed services firm.

Read More →October 20, 2020

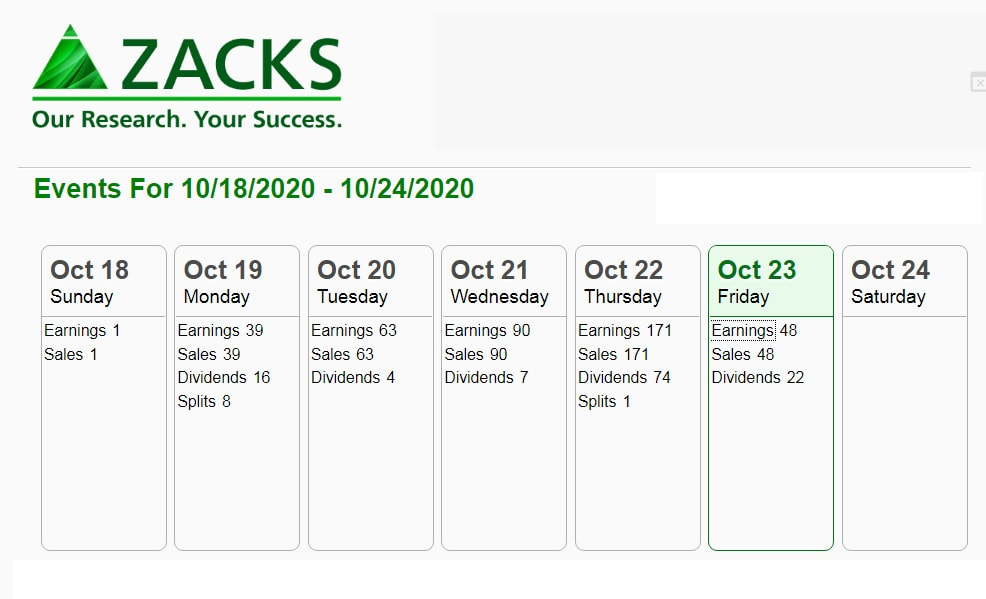

Part of an investment strategy includes tracking quarterly earnings reports such as the ones below for the week of October 19, 2020. The Zacks Earning Calendar is a good place to start to see what organizations are announcing their fiscal results.

Read More →September 10, 2020

This week's Barron's financial magazine and it's related TV show present a range of interesting topics related to finance & economics.

Read More →August 23, 2020

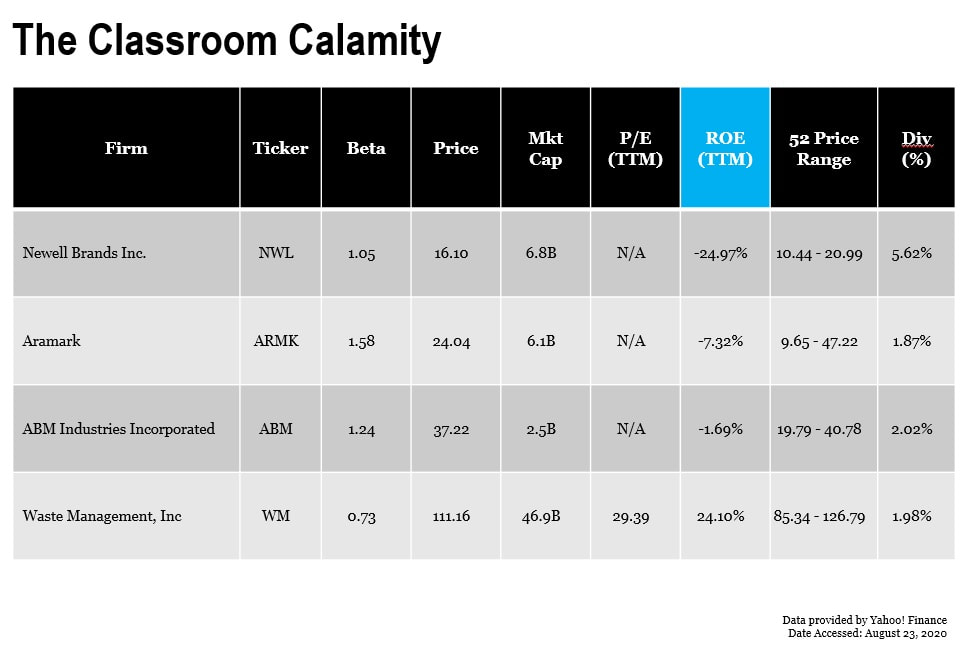

A very insightful article in this weekend's Barron's financial magazine presents some interesting statistics related to U.S. K-12 education and the economy. Specifically, these data points are interesting: "There are 56 million K-12 students in the United States.""Back-to-school is second only to the holiday season for retailers, representing about 15% of annual sales for department and specialty stores"In 2019, back-to-school spending totaled $26.2 billionExtended school closures "could cost the economy $700...

Read More →August 6, 2020

The Nasdaq closed today above 11,000 for the first time in history.It now trades at 21% above it's 200 DMA. For some historic comparison, it traded 50% more than its 200 DMA just before the 2000 eCommerce bust. (Chart via: Yahoo Finance)

Read More →